The eStore Table Rate Tax addon allows you to charge tax in the shopping cart based on the user’s country.

Installing the eStore Table Rate Tax Addon

You can install this addon the same way you install any WordPress plugin:

- Go to the “Add New” plugins screen in your WordPress admin area

- Click the “upload” tab

- Browse for the addon file (estore-table-rate-tax.zip)

- Click “Install Now” and then activate the plugin

Using this Addon

When this addon is active, You can easily configure rates that will be used to apply tax in the shopping cart based on the customer’s country.

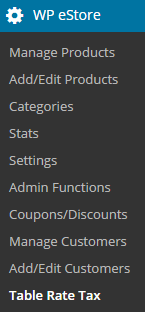

To access the addon settings click on the “Table Rate Tax” sub-menu under the WP eStore plugin menu.

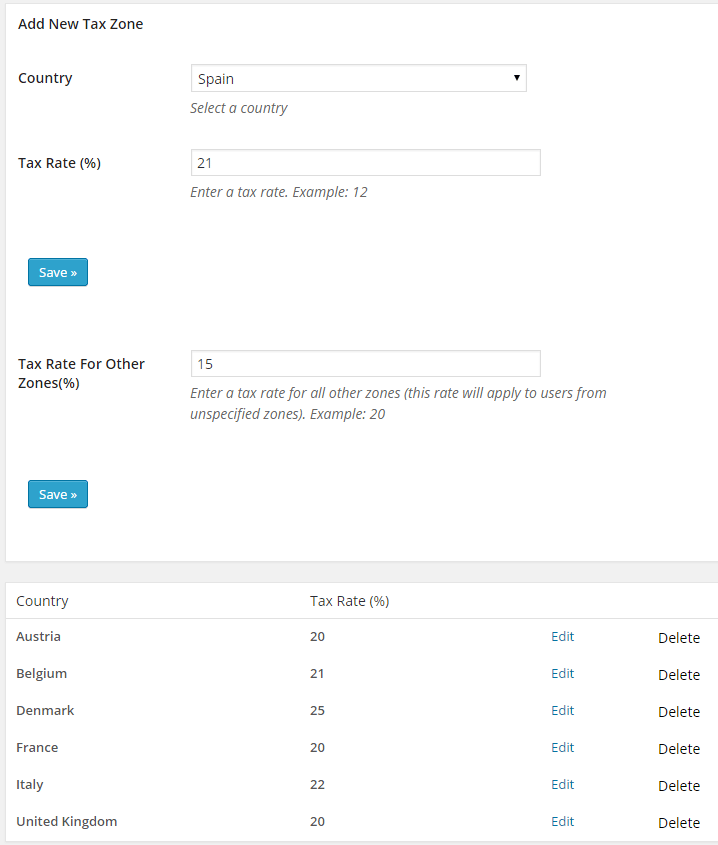

To add a new tax zone you need to select a country and specify a tax rate for it (For example: 20).

Click the “Save” button which will add the zone.

If you do not wish to configure a rate for every country you can specify a flat rate in the “Tax Rate For Other Zones” field (For example: 15). By default it is set to 0.

How Does It Work

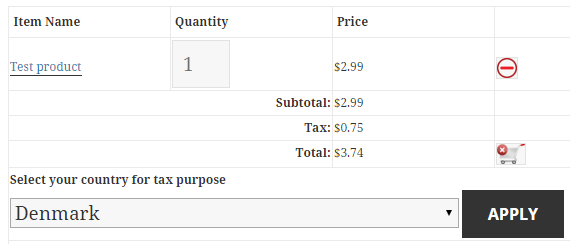

Lets say, a customer is browsing your website from Denmark. When that user adds a product to the shopping cart a 25% tax/VAT will be automatically applied.

The location of the user is determined based on the IP address. But they can also manually select their country (the addon will calculate the tax accordingly).

If the user is from a zone that you haven’t configured (Example: USA) a 15% tax will be automatically applied.

AddOn Price

The eStore Table Rate Tax Addon is FREE for all customers who purchased WP eStore plugin from us.

Download the Addon (v1.0.1)

You can download this addon from the addon download area of our customer only support forum.

General Note

Please note that some of these free eStore addons are developed by our users in the community. So they do not have any advanced customization option. The description above explains exactly what this addon does.

Note: We provide technical support for our premium plugins via our customer only support forum